Apple is preparing to launch its highly anticipated smart home device in March 2026, marking a substantial entry into the connected home market with a $350 price tag that positions it considerably above competitors like Amazon Echo Show. The device features a 7-inch display and will be available in both wall-mounted and tabletop configurations, with production handled by Chinese electric vehicle manufacturer BYD in Vietnam rather than China.

This launch represents Apple’s most serious attempt to establish a presence in the smart home device market, where the company has struggled to gain traction against Amazon and Google despite years of developing its HomeKit software platform.

Device Specifications and Product Positioning

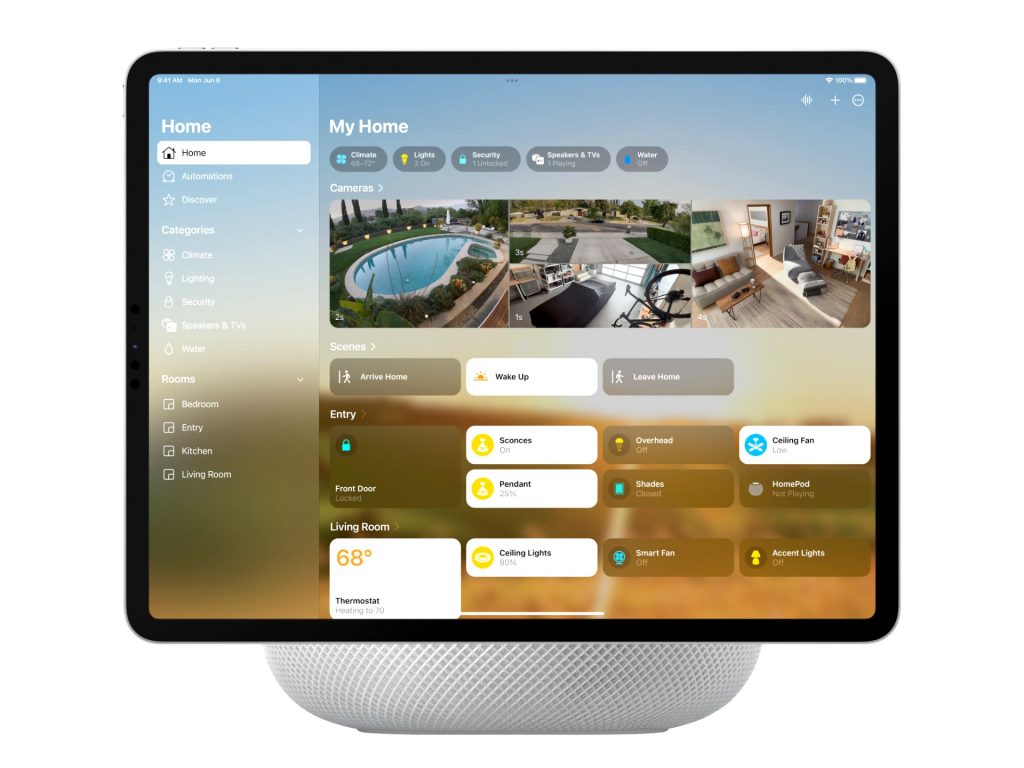

The smart home hub—internally designated as J490 for the tabletop version and J491 for the wall-mounted configuration—resembles what Bloomberg’s reporting describes as a “HomePod mini with a screen.” Both configurations incorporate FaceTime cameras and software capable of recognizing different family members, automatically adjusting available applications and features based on who’s interacting with the device.

Apple originally targeted a March 2025 launch but delayed the release to wait for an updated version of Siri built on next-generation architecture. The $350 price represents a premium over the full-size HomePod and significantly exceeds competing Amazon products, though Apple’s operations teams are exploring cost reduction strategies.

Understanding the Pricing Strategy

The $350 price point deserves careful examination within the context of the smart home display market. Amazon’s Echo Show lineup ranges from around $90 for the Echo Show 5 to approximately $280 for the Echo Show 15, making Apple’s entry price substantially higher than even Amazon’s premium offerings. Google’s Nest Hub Max, another direct competitor, typically retails around $230.

This pricing positions the Apple device as a premium smart home hub rather than an accessible entry point for the category. Several factors likely contribute to this positioning:

Hardware quality expectations: Apple consistently commands price premiums through superior build quality, display technology, and industrial design. The 7-inch display, FaceTime camera system, and family recognition capabilities suggest hardware specifications exceeding typical smart displays.

Ecosystem integration value: For users already invested in Apple’s ecosystem—iPhones, iPads, Macs, Apple Watches, AirPods—the seamless integration and continuity features may justify the premium. However, this also limits the addressable market to existing Apple customers rather than attracting new users to the ecosystem.

Margin protection: Apple’s business model depends on maintaining high margins across product categories. Entering the smart home market at competitive price points would establish lower margin expectations that could prove difficult to sustain across the product line.

Delayed Siri architecture: The decision to postpone launch for improved Siri capabilities indicates Apple recognizes that voice assistant performance represents a critical competitive factor. Amazon’s Alexa and Google Assistant have years of refinement and training data advantages. Launching with subpar voice interaction would undermine the device regardless of hardware quality.

Expanded Smart Home Product Roadmap

Apple’s plans extend beyond the initial hub device, revealing a broader smart home strategy:

Indoor security camera (codename J450): Scheduled for late 2026, this camera would compete directly with products from Ring (Amazon), Nest (Google), and specialized security camera manufacturers. Apple’s privacy-focused messaging could differentiate its offering in a market segment where data security concerns run high.

Desktop robot with motorized arm: Targeted for 2027 with a 9-inch display and articulated arm mechanism, this ambitious product would enter relatively unproven consumer territory. Expected pricing of “several hundred dollars” reflects the complex components involved. Amazon’s Astro home robot has seen limited release and mixed reception, suggesting significant execution challenges in this category.

The staggered release schedule—hub in March 2026, camera in late 2026, robot in 2027—allows Apple to establish its smart home presence incrementally while learning from each product launch before committing to the next.

Strategic Manufacturing Shift to Vietnam

The partnership with BYD for manufacturing in Vietnam marks a notable departure from Apple’s typical strategy of initially establishing new product categories in China. BYD will handle final assembly, testing, and packaging for the smart home devices, continuing Apple’s broader efforts to reduce dependence on Chinese manufacturing amid ongoing trade tensions.

Vietnam’s Growing Role in Apple’s Supply Chain

Apple has dramatically expanded its Vietnam operations: as of 2023, the country hosts 35 supplier manufacturing facilities, making it Apple’s largest manufacturing base in Southeast Asia. The company has invested approximately $16 billion in Vietnam since 2019 and already manufactures AirPods, iPads, Apple Watches, and select Mac models there.

This geographical diversification serves multiple strategic objectives:

Risk mitigation: Concentrating production in a single country creates vulnerability to political disruptions, trade policy changes, natural disasters, or pandemic-related shutdowns. Vietnam provides an alternative manufacturing hub with developing infrastructure and government support for technology manufacturing.

Labor cost optimization: While Vietnam’s labor costs have risen as the country develops, they generally remain lower than China’s coastal manufacturing regions where Apple has traditionally concentrated production. However, Vietnam still faces infrastructure and logistics challenges compared to China’s mature manufacturing ecosystem.

Trade policy navigation: The manufacturing shift occurs as former President Trump threatened additional tariffs on Chinese goods and indicated plans to target countries participating in Chinese supply chains. However, products manufactured in Vietnam still face tariffs under current US trade policy—specifically a 20% rate on Vietnamese imports.

Tariff Implications for Pricing and Margins

The 20% tariff on Vietnamese imports creates immediate cost pressures that likely contribute to the $350 price point. For a $350 retail device, the tariff adds substantial costs that Apple must either absorb (reducing margins) or pass to consumers (increasing prices further above competitors).

This tariff situation presents a strategic dilemma: manufacturing in China would face potential tariff increases given current trade tensions, while manufacturing in Vietnam incurs existing 20% tariffs. Apple appears to be betting that long-term trade policy will favor non-Chinese manufacturing despite current tariff structures, or that the company can negotiate more favorable terms as US-Vietnam trade relationships evolve.

Evaluating Market Position and Competitive Challenges

Apple’s entry into the smart home hub market faces substantial challenges from entrenched competitors who have spent years refining their products, building user bases, and training their AI assistants.

Amazon’s Ecosystem Advantages

Amazon dominates the smart home hub market through several structural advantages:

Alexa’s training data: Years of user interactions have trained Alexa’s natural language understanding across diverse accents, phrasings, and use cases. Apple’s updated Siri architecture will need time to achieve comparable performance.

Third-party integrations: Thousands of smart home devices work with Alexa, creating strong network effects. Apple’s HomeKit has fewer compatible devices, though the Matter standard aims to improve cross-platform compatibility.

Aggressive pricing: Amazon often prices Echo devices at or near cost, using them as loss leaders to drive Amazon services adoption (Prime, Music, Shopping). Apple’s business model doesn’t support this approach.

Market presence: Echo devices are ubiquitous in homes, offices, and hotels. This installed base creates familiarity and switching costs for users considering alternatives.

Google’s Integration Strengths

Google brings complementary advantages through Nest Hub devices:

Search integration: Google’s core search capabilities enhance voice query responses, particularly for general knowledge questions and local business information.

YouTube access: Native YouTube integration provides extensive video content that Apple’s device may lack due to ongoing app store disputes.

Photo integration: Google Photos’ unlimited storage (for compressed photos) and AI-powered organization create compelling use cases for display devices that Apple must match through iCloud.

Apple’s Potential Differentiators

Despite these challenges, Apple possesses specific advantages that could resonate with target customers:

Privacy positioning: Apple’s emphasis on on-device processing and privacy protection appeals to users concerned about always-listening devices sending data to cloud servers. If the family recognition and Siri processing occur primarily on-device, this becomes a meaningful differentiator.

Ecosystem continuity: For households already using iPhones, iPads, and Macs, features like Handoff, Universal Clipboard, AirDrop, and iMessage integration could provide seamless experiences unavailable on competing platforms.

Build quality and design: Apple’s reputation for industrial design and build quality typically exceeds competitors in comparable price ranges. The device’s appearance matters for a product intended to sit prominently in homes.

FaceTime capabilities: High-quality video calling through FaceTime could differentiate the hub, particularly as remote work and distributed families normalize video communication. However, this requires other family members to also use Apple devices for maximum utility.

Family Recognition Technology and Privacy Considerations

The family recognition software represents an intriguing technical challenge with significant privacy implications. The system must reliably distinguish between family members while maintaining Apple’s privacy commitments.

Technical Implementation Questions

Several technical details remain unclear about the family recognition system:

Enrollment process: How do families initially train the device to recognize different members? Does it require multiple registration sessions from various angles and lighting conditions? Can it distinguish between family members with similar appearances?

Recognition methodology: Does the system use facial recognition, voice recognition, or both? On-device processing would align with Apple’s privacy stance but requires significant local compute power. Cloud-based processing would enable better accuracy but contradicts privacy messaging.

Age considerations: How does the system handle children who grow and change appearance over time? Automatic profile updates could maintain accuracy but raise questions about data retention and processing.

Privacy controls: Can users see what data the device collects and stores about their appearance or voice? Can they delete their profile completely? How does Apple prevent misuse if someone gains physical access to the device?

Personalization Benefits

If implemented effectively, family recognition enables compelling personalization:

Content appropriateness: Children’s profiles could restrict access to certain apps, limit shopping capabilities, or filter content based on age ratings.

Personal information access: Each family member sees their own calendar, messages, reminders, and notifications rather than shared or generic information.

Preference learning: The device learns individual preferences for music, news sources, smart home settings, and frequently used apps, presenting relevant options based on who’s interacting.

Shared family functions: Certain features like shopping lists, family calendars, and home automation controls remain accessible to all family members while maintaining individual preferences elsewhere.

Assessing Launch Timing and Market Conditions

The March 2026 launch timing occurs within a specific market context that influences potential success:

Matter standard maturation: The Matter smart home standard, which Apple supports, should be more mature by March 2026, potentially improving interoperability with non-Apple smart home devices and reducing HomeKit’s historical compatibility limitations.

Siri advancement readiness: The year-long delay specifically for improved Siri architecture suggests Apple recognizes voice assistant performance as critical. The next-generation Siri should demonstrate meaningful improvements over current capabilities to justify the wait.

Economic conditions: Consumer spending on discretionary technology products like smart home hubs fluctuates with economic conditions. The $350 price point positions this as a premium purchase that’s sensitive to economic headwinds.

Competitive product cycles: Amazon and Google will launch multiple Echo and Nest Hub iterations between now and March 2026, potentially incorporating their own AI advancements and feature improvements that raise the competitive bar.

Production Partnership with BYD: Implications and Risks

Apple’s selection of BYD—primarily known as an electric vehicle manufacturer—for smart home hub production represents an unconventional partnership worth examining.

Why BYD?

Several factors may explain Apple’s choice of BYD for this manufacturing relationship:

Manufacturing expertise: Despite their EV focus, BYD possesses extensive electronics manufacturing capabilities and experience with complex assembly processes, quality control systems, and supply chain management.

Vietnam presence: BYD has established manufacturing operations in Vietnam, providing the geographic diversification Apple seeks without requiring Apple to develop entirely new supplier relationships.

Capacity availability: Unlike Apple’s traditional suppliers (Foxconn, Pegatron) whose capacity is heavily committed to iPhone and iPad production, BYD may have available manufacturing capacity for a new product category.

Strategic relationship building: As BYD explores opportunities beyond automotive manufacturing, partnership with Apple provides validation and potential pathways to additional technology manufacturing contracts.

Potential Risks

This manufacturing arrangement also carries risks:

New product category execution: BYD’s experience primarily involves vehicles and larger electronic devices rather than compact smart home products. The learning curve could impact initial production quality or yields.

Supply chain complexity: Introducing a new manufacturer into Apple’s supply chain requires establishing quality standards, logistics coordination, and supply chain integration that typically takes time to optimize.

Geopolitical considerations: BYD’s Chinese ownership combined with Vietnam manufacturing creates a hybrid situation that may not fully achieve Apple’s de-risking objectives if US-China tensions escalate further.

Scale limitations: If the smart home hub succeeds beyond initial expectations, can BYD scale production rapidly enough to meet demand, or would Apple need to add manufacturing partners?

Market Opportunity and Realistic Expectations

The smart home hub market presents both opportunities and limitations for Apple’s entry:

Addressable Market Scope

Research firms estimate the global smart speaker market at approximately $15-20 billion annually, with display-equipped devices representing a smaller but growing segment. Apple’s premium pricing and ecosystem requirements limit the addressable market to:

Existing Apple ecosystem users: Households already invested in iPhones, iPads, and potentially other Apple devices represent the primary target market. Cross-platform appeal will likely be minimal given limited Android integration.

Premium-focused consumers: The $350 price restricts the market to consumers willing to pay significant premiums for perceived quality and ecosystem benefits rather than price-conscious buyers.

Privacy-concerned users: Specific subset of consumers who prioritize on-device processing and privacy commitments over voice assistant capabilities or third-party integrations.

Realistic Volume Expectations

Given these constraints, realistic first-year volume expectations likely range between 5-10 million units—meaningful for a new product category but small relative to iPhone volumes. This would establish Apple’s presence without requiring the manufacturing scale that has historically challenged new product launches.

Success metrics should focus on:

Ecosystem attachment rates: What percentage of existing Apple customers adopt the hub? Higher attachment rates within the installed base matter more than total volume.

Average selling price maintenance: Can Apple sustain $350 pricing or will competitive pressure force discounting?

Satisfaction and retention: Do users actively engage with the device long-term or does it become dormant like many smart speakers?

Platform development: Do third-party developers create compelling applications and integrations that enhance the platform’s value over time?

Strategic Implications for Apple’s Smart Home Ambitions

The hub launch represents more than a single product introduction—it signals Apple’s renewed commitment to competing seriously in the smart home category after years of underwhelming HomeKit traction.

Building Blocks for Ecosystem Expansion

The March 2026 hub, late 2026 security camera, and 2027 desktop robot form a staged approach to building a comprehensive smart home ecosystem. This strategy allows Apple to:

Establish core platform: The hub becomes the central control and interaction point for additional smart home devices.

Expand gradually: Rather than launching multiple products simultaneously and dividing resources, Apple can focus execution on sequential launches while learning from each release.

Build developer interest: A successful hub launch could revitalize developer interest in HomeKit and Matter-compatible device development, expanding the compatible device ecosystem.

Test market reception: The hub’s performance will inform strategy for subsequent products, potentially accelerating or adjusting plans for the camera and robot based on real-world feedback.

Long-Term Vision Questions

Several strategic questions remain about Apple’s long-term smart home ambitions:

Services monetization: How will Apple monetize the smart home platform beyond hardware sales? Will there be subscription tiers for advanced features, similar to iCloud storage?

Market share goals: Is Apple targeting meaningful market share against Amazon and Google, or is it content serving its existing ecosystem at premium prices?

Innovation leadership: Does Apple see opportunities to fundamentally reimagine smart home interaction, or is it primarily bringing its execution standards to existing product categories?

Matter strategy: How aggressively will Apple embrace cross-platform compatibility through Matter versus maintaining HomeKit exclusivity for certain features?

The answers to these questions will emerge as the product launches and evolves, but they ultimately determine whether this represents a transformative entry into smart home or an incremental ecosystem expansion with limited market impact.

Apple’s March 2026 smart home hub launch marks a significant strategic move for a company that has watched Amazon and Google dominate the connected home market for years. The $350 price point, Vietnam manufacturing, family recognition capabilities, and delayed Siri improvements reveal a company approaching the category with characteristically high hardware standards but facing meaningful competitive challenges.

For potential buyers, the decision will likely hinge on existing ecosystem investment and priority weighting between privacy, integration, voice assistant capabilities, and price. Apple ecosystem devotees may find the $350 premium justified for seamless device integration and privacy commitments, while price-sensitive consumers or those outside Apple’s ecosystem will likely find better value in competing products.

The manufacturing partnership with BYD in Vietnam demonstrates Apple’s ongoing supply chain diversification despite tariff complications, suggesting the company views geographic risk mitigation as a long-term priority worth near-term cost increases.

Success will ultimately depend on execution: can the updated Siri architecture compete effectively with Alexa and Google Assistant? Does the family recognition work reliably without privacy concerns? Will the build quality and ecosystem integration justify the premium pricing? These questions will be answered when devices reach consumers in March 2026, determining whether this represents a turning point in Apple’s smart home presence or another well-executed but ultimately limited-appeal product in a market where competitors have years of refinement and entrenched user bases.

Post a comment