AltStore, an alternative iPhone app marketplace, closed a $6 million Series A round from Pace Capital, positioning the startup to capitalize on regulatory shifts forcing Apple to open its ecosystem beyond the European Union. The funding enables the two-person team to extend the platform into Australia, Brazil, and Japan by year’s end, with UK expansion planned for 2026.

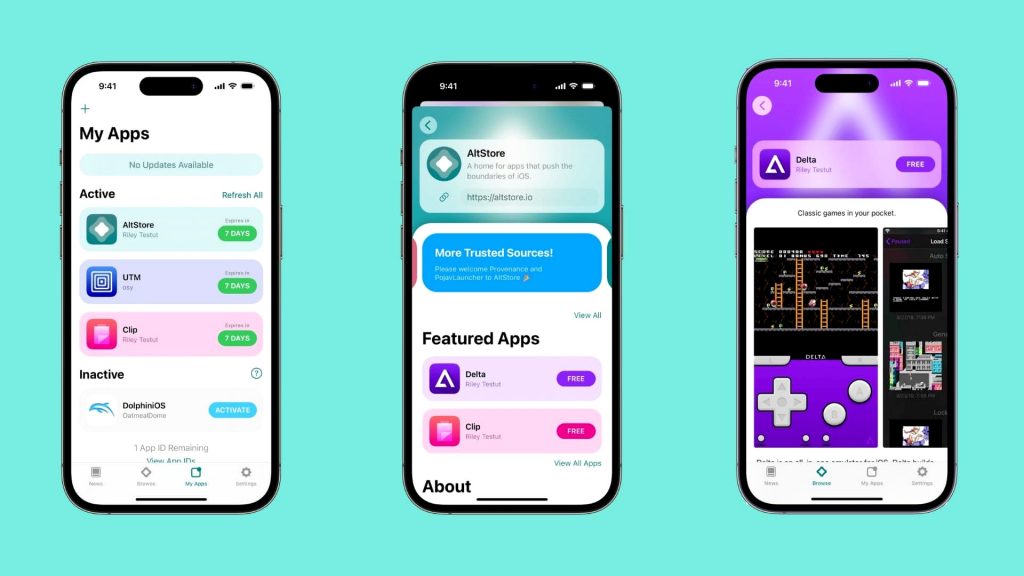

Developer co-founders Riley Testut and Shane Gill built AltStore as one of the first alternative EU app stores after the Digital Markets Act took effect earlier this year. The company scaled from offering just two applications at launch to hosting over 100 developers on its AltStore PAL platform, including high-profile additions like Epic Games’ Fortnite and adult content applications that violate Apple’s stricter policies.

International Growth Accelerates as Regulations Spread

The $6 million investment, giving Pace Capital a 15% equity stake, arrives as multiple countries adopt regulatory frameworks mirroring the EU’s approach to breaking app store monopolies. Japan’s Fair Trade Commission approved new guidelines in August 2025 requiring Apple to permit third-party app stores and payment systems starting December 18, 2025. Similar regulations are developing in Australia and Brazil, creating opportunities for AltStore’s international launches.

“We’re aiming to launch in Brazil and Australia before the end of the year,” Testut told media outlets, noting that international expansion represents “definitely the most common request” from users. The timing aligns with mounting regulatory pressure worldwide as countries follow the EU’s lead in challenging Apple’s control over iOS app distribution.

Fediverse Integration Creates Discovery Layer

Beyond geographic expansion, AltStore is pioneering integration with the fediverse through its own Mastodon server running on the ActivityPub protocol. This feature will let developers automatically post app updates to users following them on Mastodon, Meta’s Threads, or eventually Bluesky. “People will be able to reply to apps from their Mastodon account. They’ll be able to like from their Threads account,” Testut explained, describing the social layer being added to app discovery.

Flipboard CEO Mike McCue, a prominent fediverse advocate, joined AltStore’s board as part of the funding round. The company plans to allocate $500,000 from the new investment toward supporting fediverse projects, including donations to Mastodon gGmbH, Bridgy Fed, and other open social network initiatives.

Digital Markets Act Reshapes iOS Distribution

The Digital Markets Act fundamentally altered iOS app distribution by forcing Apple to abandon its longstanding installation monopoly. Under this legislation, which took effect in March 2024, Apple must now allow alternative app stores and sideloading for EU users, removing barriers that previously restricted developers to the official App Store. These regulatory changes opened possibilities for AltStore to transition from a sideloading tool requiring developer certificates into a legitimate marketplace with streamlined installation processes.

The DMA’s impact extends beyond technical compliance—it established precedent for similar regulatory initiatives globally. Apple’s resistance to these changes, including introducing the controversial Core Technology Fee for apps distributed outside its store, demonstrates major platforms’ reluctance to relinquish control. However, early alternative stores like AltStore successfully attracting major developers such as Epic Games proves viable alternatives can emerge when regulatory barriers fall, laying groundwork for the global expansion now happening through new venture investment.

The marketplace already differentiates itself by hosting content Apple traditionally blocks. Adult applications and games that circumvent App Store guidelines find a home on AltStore, appealing to users frustrated by Apple’s content restrictions. This positioning as a less restrictive alternative could prove valuable as the platform enters new markets, particularly where users have grown accustomed to more open Android ecosystems.

Testut and Gill’s decision to bootstrap initially before raising institutional capital reflects confidence in regulatory momentum. The small team size—just two people—raises questions about scaling operations across multiple countries simultaneously, though the $6 million provides runway to expand staffing as needed. Whether AltStore can execute rapid international launches while building out fediverse integration and maintaining platform quality will test the startup’s operational capabilities.

The 15% equity stake Pace Capital received suggests a post-money valuation around $40 million, a modest figure given the potential market opportunity if alternative app stores gain meaningful traction. That valuation likely reflects both the early-stage nature of the business and uncertainties around how quickly regulations will force Apple to open additional markets beyond those already committed.

Apple’s response to alternative app stores has been grudging compliance rather than enthusiastic cooperation. The Core Technology Fee and other friction points the company introduced suggest it will continue making third-party distribution as difficult as regulations permit. AltStore’s success depends partly on whether regulators enforce the spirit of their rules rather than allowing minimal technical compliance that preserves Apple’s practical control.

Post a comment